This post covers letter for debt settlement.

Half of Americans consistently struggle to pay their bills on time (source).

I know, sometimes you might be very ready to pay the debt but due to your financial constraints, you are unable to pay the entire amount.

Now!

How do you tell your creditor or collection agent that you need a payment schedule?

Transform Your Communication, Elevate Your Career!

Ready to take your professional communication skills to new heights? Dive into the world of persuasive business correspondence with my latest book, “From Pen to Profit: The Ultimate Guide to Crafting Persuasive Business Correspondence.”

What You’ll Gain:

It is simple like drinking a coffee

Write a Letter for debt settlement.

A debt settlement letter is an excellent instrument for negotiating with your creditor all feasible options for debt settlement.

Through this letter, you can request to pay your entire debt in installments for a specific period or propose settling the account for a reduced amount in case you are unable to pay the full amount.

On average, debt settlement saves consumers $2.64 for every $1 in fees paid (source)

Writting an effective Letter for debt settlement is a huge legal responsibility regardless it is your first or 100th time.

You really need a detailed guide for that.

Here I will take you through

- What is Letter for debt settlement?

- Is Letter for debt settlement binding?

- Why is it necessary?

- How to write a winning letter for debt settlement

- sample letter for debt settlement

- What should you do after sending your letter for debt settlement?

- What if your letter for debt settlement does not work?

- etc.

Let’s get started

Related:

- Pay for deletion letter (guide + free samples)

- Goodwill deletion letter (guide + free samples)

- Letter for debt forgiveness (guide + free samples)

- Personal Loan Forgiveness Letter Sample

What is Letter for debt settlement?

A Letter for debt settlement is a brief statement of facts written by a debtor to a creditor or collection agent to request, offer, or negotiate a proper mechanism to settle a debt. It can be to offer a certain amount of money in exchange for forgiveness of debt, request to pay your entire debt in installments for a certain period of time or propose settling the account debt for a reduced amount in case he is unable to pay the full amount.

A debt settlement letter includes a proposal that, if accepted, should pave the way for negotiations on a fair and reasonable debt settlement procedure.

This letter should normally explain why you are unable to pay the entire debt, how much you are ready to pay right now, and what action you expect from the creditor in exchange.

Is Letter for debt settlement binding?

A Letter for debt settlement is not legally binding.

It is merely an offer or proposal to settle a debt in a certain way.

A creditor or collection agency is not bound to accept or in any way consider it.

He may choose to respond by ‘not responding’.

But when a creditor agrees to your Letter for debt settlement, you will sign a debt settlement agreement that is legally binding.

Why do you need a letter for debt settlement?

You already know that a letter for debt settlement is not legally enforceable.

Do I still need to use it?

A big YES.

Here is why

The primary reason you require a debt settlement letter is to obtain debt relief. When you try to eliminate debt through debt settlement, you may reduce your use of credit, which raises your credit score.

A letter for debt settlement can also help you avoid anxiety, stress, and overwhelming collection procedure by alerting the creditor that you are ready to pay the debt.

How to write a letter for debt settlement

A letter for debt settlement is written in a business letter format. Begin your letter with your address and contact information, followed by a date and the collector or creditor’s address, and state that you are writing to request a debt payment relief since you are unable to pay the entire amount. Explain why you are unable to repay the entire debt, how much you can currently afford to pay, and what response you expect in return from the creditor.

Finish with “Sincerely,” followed by your name and signature.

REMEMBER! the main purpose of your letter for debt settlement is to obtain debt relief.

Therefore, to write an effective letter for debt settlement, do the following.

- Include your name and contact information

- Include the date of the letter

- Include the creditor/collector’s address

- Include your account number

- Explain why you are unable to repay the entire debt.

- Specify how much you can afford to pay

- Attach necessary documentation-medical records or other documented proof of your circumstances.

- Explain how the adjustment will help you.

- Specify what you expect from the creditor in return

- Maintain a professional tone

- Be honest

other useful tips

- Send your letter by certified mail with a return receipt requested so you know when and if the creditor receives it.

- Keep a copy.

Please be aware that before writing your letter for debt settlement choose between working on your own or hiring debt settlement specialists.

Professionals can be quite helpful, but occasionally their costs might be extremely high.

Also before even starting, save up the amount of money you are proposing.

Keep it on standby.

If the creditor agrees to your request, you will be required to pay the agreed-upon sum within the allotted time frame.

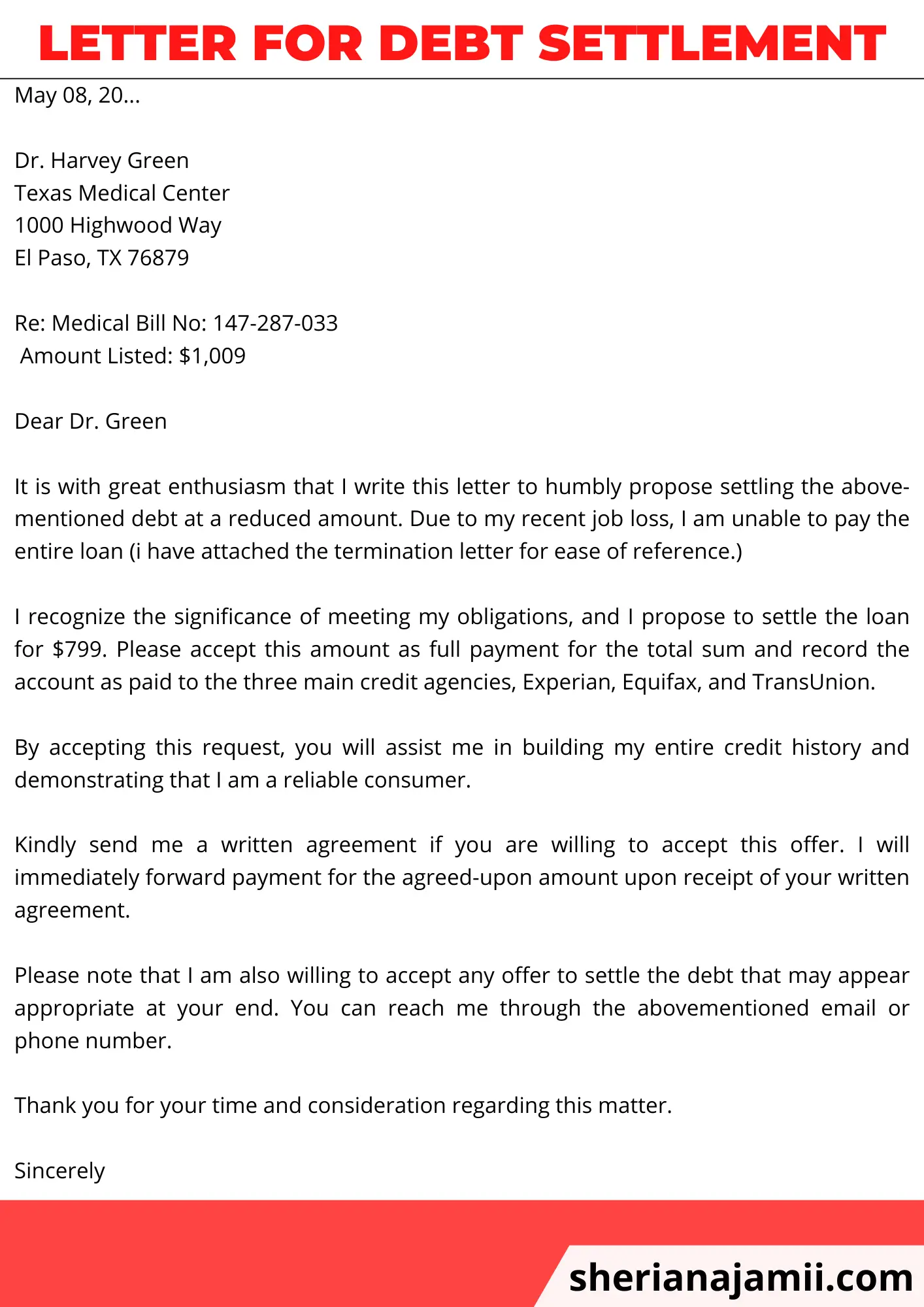

Sample letter for debt settlement

James O’Connor

1800 Glendora Ct

El Paso, TX 79210

(940) 765-6565

O’[email protected]

May 08, 20…

Dr. Harvey Green

Texas Medical Center

1000 Highwood Way

El Paso, TX 76879

Re: Medical Bill No: 147-287-033

Amount Listed: $1,009

Dear Dr. Green

It is with great enthusiasm that I write this letter to humbly propose settling the above-mentioned debt at a reduced amount. Due to my recent job loss, I am unable to pay the entire loan (i have attached the termination letter for ease of reference.)

I recognize the significance of meeting my obligations, and I propose to settle the loan for $799. Please accept this amount as full payment for the total sum and record the account as paid to the three main credit agencies, Experian, Equifax, and TransUnion.

By accepting this request, you will assist me in building my entire credit history and demonstrating that I am a reliable consumer.

Kindly send me a written agreement if you are willing to accept this offer. I will immediately forward payment for the agreed-upon amount upon receipt of your written agreement.

Please note that I am also willing to accept any offer to settle the debt that may appear appropriate at your end. You can reach me through the abovementioned email or phone number.

Thank you for your time and consideration regarding this matter.

Sincerely

Signature

James O’Connor

Letter for debt settlement pdf

What should you do after sending your letter for debt settlement?

After you write and send the letter to the debt collection agency, you will have to wait for a response. Be advised that you may or may not receive a response.

If the creditor or debt collector answers, make sure they include an assurance that they will accept your proposed offer.

This assurance should be written down, ideally on company letterhead.

Pay the creditor or debt collection agency what you agreed to pay if they accept your written offer to settle the debt in full or in part with a payment plan.

Remember that if the creditor or collection agency rejects your offer rather than informing you of their decision, they may “react by not responding.”

Your debt settlement letter may have been unsuccessful if you did not receive explicit, favorable responses in writing from them.

What if your letter for debt settlement does not work?

Regrettably, there is no guarantee that your letter for debt settlement offer will be approved.

Your debt relief offer is only a request.

If your letter was unsuccessful, here is what you can do:

- Find a means to pay up your bills in full anyway; a zero balance is always better than an outstanding balance.

- Do not pay a dime and wait until your credit reporting limit is reached 7 years and the item is erased from your credit report. It is crucial to understand that collection efforts will continue (you can stop third-party collector calls with a cease and desist letter) and that you may be sued for the debt.

Read also

![Sample letter to decline job offer [2025] 3 letter to decline job offer, sample letter to decline job offer](https://sherianajamii.com/wp-content/uploads/2025/01/letter-to-decline-job-offer-768x1086.png)

![Meeting cancellation notice 2025 [samples] 4 meeting cancellation notice, meeting cancellation notice sample, meeting cancellation notice examples, meeting cancellation notice template](https://sherianajamii.com/wp-content/uploads/2024/01/meeting-cancellation-notice-768x1086.png)

![Event cancellation notice due to weather 2025 [examples] 5 event cancellation notice due to weather , event cancellation notice due to weather examples](https://sherianajamii.com/wp-content/uploads/2024/01/event-cancellation-notice-due-to-weather--768x1086.png)