This post covers the Debt Acknowledgement Letter.

An individual may find themselves unable to pay one or more of their creditors, and the such creditor may, after discussing payment terms, request that such individual enter into something known as an “Acknowledgement of Debt.”

The average American debt (per U.S. adult) is $58,604 and 77% of American households have at least some type of debt.

ramseysolutions

Acknowledging a debt is not easy, but when circumstance renders it necessary, getting a formal letter acknowledging a debt is an excellent way to ensure debt repayment.

Here I will guide you on

Transform Your Communication, Elevate Your Career!

Ready to take your professional communication skills to new heights? Dive into the world of persuasive business correspondence with my latest book, “From Pen to Profit: The Ultimate Guide to Crafting Persuasive Business Correspondence.”

What You’ll Gain:

- what is Debt Acknowledgement Letter?

- why is it necessary

- How to write a Debt Acknowledgement Letter

- Debt Acknowledgement Letter sample

- etc.

Jump to section

What is Debt Acknowledgement Letter?

A Debt Acknowledgement Letter is a brief written statement of facts that confirms the debtor owes money to the creditor.

As it contains an admission of liability to repay the debt, this letter serves as strong evidence that the debtor owes a certain amount of money.

The Debt Acknowledgement Letter differs from the Loan Agreement, which is more detailed and specifies the terms and conditions of a loan facility. However, this letter only acknowledges a party’s debt.

Acknowledgement of debt Letter can be alternatively referred to as a Deed of Acknowledgement of Debt.

It is an excellent way to document a monetary or asset loan to another person.

Further, a promissory letter/note for payment works as great as an acknowledgement of debt letter.

Why do you need a Debt Acknowledgement Letter?

Debt acknowledgement letters serve as proof that a borrower owes money to a creditor.

It formalizes an agreement to lend money or assets and provides a solid reference point to which to return if necessary.

If either party is unsure or threatens not to repay the loan, the debt acknowledgement letter serves as a good record of what was originally intended. This is essential for timely debt repayment.

It can be a very useful tool for avoiding the high costs of litigation because it allows the creditor to easily prove the existence and amount of the debt.

The Debt Acknowledgement Letter also shows the creditor that you appreciate his time and assistance.

A letter of acknowledgement of debt in the business world indicates when the debt was advanced and when it will be paid. This practice aids in the development of positive business relationships.

How to write a Debt Acknowledgement Letter

Acknowledgement of Debt letter is formatted as a business letter. Begin your letter with your name and address, followed by a date and the creditor’s address, and state that you are writing to acknowledge the debt. Finish with “Best Regards,” then your name and signature.

The Debt Acknowledgement Letter is frequently written in conjunction with a payment plan for debt and includes some form of security or other methods of assurance in favour of a creditor (for example, interest rate, witnesses, etc.).

REMEMBER! The debt acknowledgement Letter’s purpose is to acknowledge that the debtor owes money to the creditor

Writing a debt acknowledgement Letter is not a difficult task; it simply necessitates paying attention to some technical details and some important points that may be related to the law.

Do the following to write an effective debt acknowledgement Letter;

- Provide your name, address, and contact information

- Include the date of the letter

- Include the name and creditor’s address

- Clearly states the amount owed

- State the reasons for the debt

- Provide the final date of repayment

- Include at least two witnesses

- Maintain a professional tone

- Be honest

Format of Debt Acknowledgement Letter

The following is the format of the Debt Acknowledgement Letter

- Your Address

- Date

- Creditor’s address

- Subject line

- Salutation

- [opening paragraph]- A statement that you are writing to acknowledge the debt

- [body paragraphs]- details of the debt- amount, cause, date of repayment etc.

- [closing paragraphs] -witnessed

- name and signature

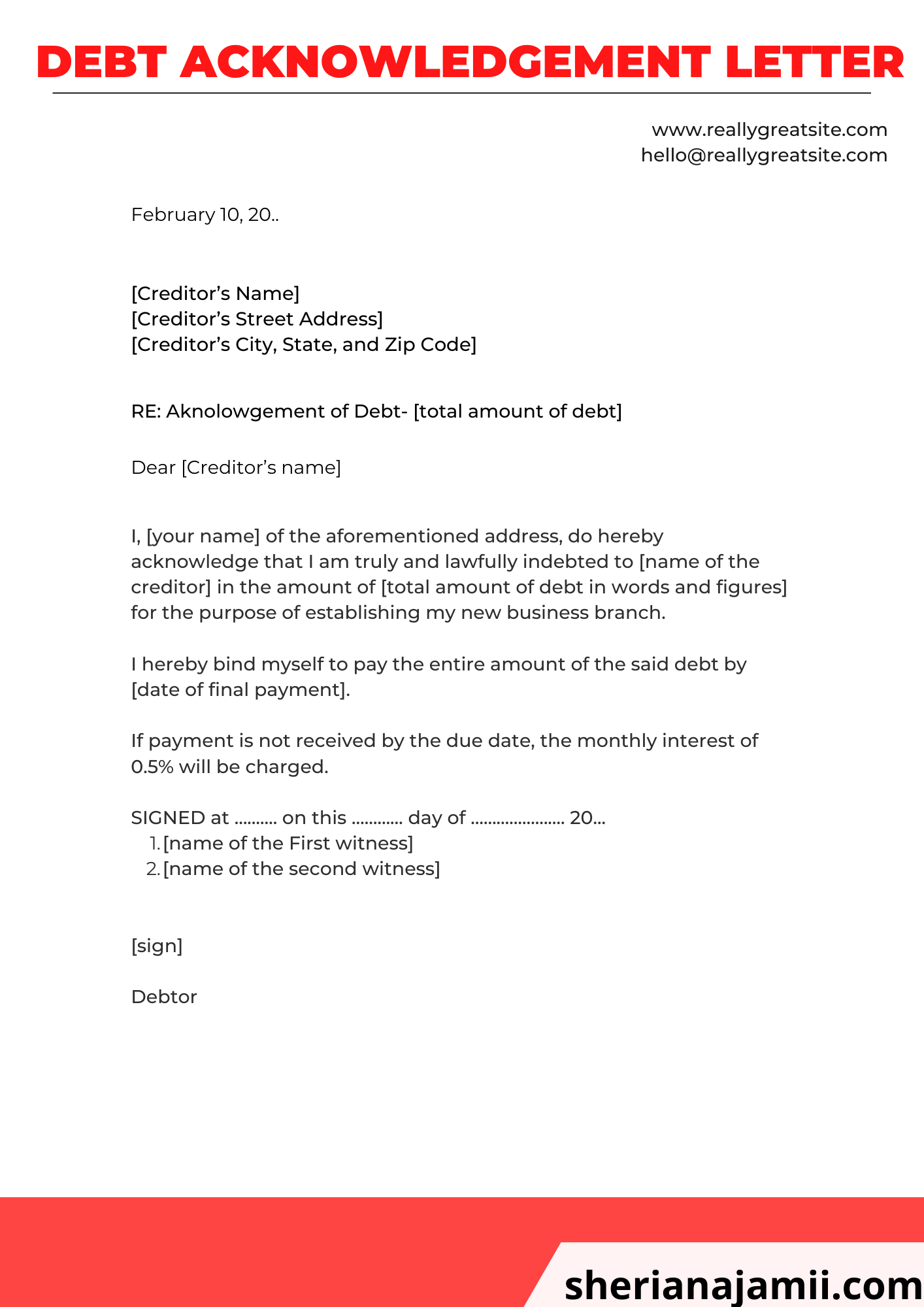

Sample Debt Acknowledgement Letter

Your Name

Your Address

City, State, Zip Code

phone

email

DATE

[Creditor’s Name]

[Creditor’s Street Address]

[Creditor’s City, State, and Zip Code]

RE: Aknolowgement of Debt- [total amount of debt]

Dear [Creditor’s name]

I, [your name] of the aforementioned address, do hereby acknowledge that I am truly and lawfully indebted to [name of the creditor] in the amount of [total amount of debt in words and figures] for the purpose of establishing my new business branch.

I hereby bind myself to pay the entire amount of the said debt by [date of final payment].

If payment is not received by the due date, a monthly interest of 0.5% will be charged.

SIGNED at ………. on this ………… day of …………………. 20…

- [name of the First witness]

- [name of the second witness]

[sign]

Debtor

Read also: