This post covers debt validation letter.

let me hit you with the stats first.

In August 2021, approximately 64 million people with a credit record (roughly 28% of Americans) had debt on their credit report, decreasing from 68 million in 2019. (source)

So what?

Debt collectors are aggressive when requesting payment for debts they believe you owe.

Transform Your Communication, Elevate Your Career!

Ready to take your professional communication skills to new heights? Dive into the world of persuasive business correspondence with my latest book, “From Pen to Profit: The Ultimate Guide to Crafting Persuasive Business Correspondence.”

What You’ll Gain:

They can tirelessly call, text, and bother you( i have already shown how to stop them through this cease and desist letter)

But, apart from cease and desist letter, another effective way to respond to the debt collector’s ‘disturbance’ is by sending them a strong debt validation letter to dispute the debt or ask for more details concerning the debt.

Now! how do you write an effective debt validation letter to dispute the debt? what to include in your letter?

I will guide you in everything you need to know about that.

Here I will take you through

- What is a debt validation letter?

- Why do you need a debt validation letter?

- When do you need a debt validation letter?

- How to write a strongest debt validation letter

- What should you do after sending a debt validation letter?

- Format of debt validation letter

- Sample of debt validation letter

- etc.

Let’s get started!

Related:

- Debt collection letter (guide + free samples)

- Pay for deletion letter (guide + free samples)

- Goodwill deletion letter (guide + free samples)

What is a debt validation letter?

A debt validation letter or validation of debt letter is a written statement of facts written by a consumer to a debt collector to dispute the debt or/and ask for more details concerning the debt.

Through a debt validation letter, You’re technically saying: “Tell me more about this debt.”

After receiving a collections request, you have 30 days under the Fair Debt Collection Practices Act (FDCPA) to request debt validation.

If you wait any longer, the debt collector is not obliged to respond to your request.

Alternatively, you can refer to a debt validation letter as a dispute of debt letter/ debt dispute letter.

Why do you need a debt validation letter?

To clearly answer this question, I will give you a short legal background to make you understand what we are exactly doing here.

The FDCPA (§ 809 (a)) requires collectors, within five days of the initial contact, to send you a written debt collection notice with information about the debt they’re attempting to collect.

Their notice must contain;

- The amount owed.

- The name of the creditor seeking payment.

- A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact.

- A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail.

- A statement that if you request information about the original creditor within 30 days, the collector must provide it.

Therefore you need a debt validation letter as a statutory response to challenge the debt collection notice from the debt collector.

A well-written debt validation letter will help you determine the validity of the debt by

- enquiring as to why the collector believes you owe the debt

- Requesting a copy of the most recent billing statement sent by the original creditor, the amount owed when the collector purchased the debt, the date of the most recent payment, and whether the debt has passed the statute of limitations.

- Inquire whether this collection agency is authorized to collect debt in your state.

When do you need a debt validation letter?

You will mostly need a debt validation letter in two situations;

- If you’re dealing with a zealous debt collector.

- here a debt verification letter can assist you in stopping collection efforts and may deter debt collectors who lack sufficient information.

- If you wish to pay the debt

- here you require additional information to ensure that you are paying the correct collector for the correct debt.

NB: If the debt is over the statutory limitation period (time-barred debt,) you may ignore the collection notice.

How to write a debt validation letter

The format of a debt validation letter is a business letter. Begin your letter with your address and contact information, followed by a date and the collector’s address, and state that you are writing in response to a debt collection notice, and that you would like more information about the debt. Finish with “With Regards,” followed by your name and signature.

REMEMBER! the main purpose of a validation letter is to dispute the debt or to request additional information about the debt.

Therefore, to write an effective debt validation letter, do the following.

- Include your name and contact information

- Include the date of the letter

- Include the collector’s address

- Include only the information (account numbers, account balances, etc.) already provided by the debt collector in her previous communications (If you give the debt collector more information than they already have, they may be able to use it against you in court if they sue.)

- Clearly states that you want him to give the information concerning

- Why does he think you owe the debt and to whom you owe it?

- the amount and the age of the debt

- his authority to collect the debt

- Do not admit that you owe the debt (refer to the debt as the “alleged debt.” all the time. If you admit that you owe the debt, you may be able to reset the statute of limitations timeline.)

- Inquire if he will accept payment less than the balance he is claiming is owed

- Maintain a professional tone

- Be honest

other useful tips

- Send your letter by certified mail with a return receipt requested so you know when and if the creditor receives it.

- Keep a copy.

- You can also ask that the debt collector only contact you through your lawyer, or you can specify which contact methods are permitted.

What should I do after sending a debt validation letter?

The only thing you should do after seeing a debt validation letter is waiting for the collector’s response.

Debt collectors should send you any documentation they have that you owe the debt after you have mailed your request.

If they don’t have enough information to prove you owe it, they may stop all collection efforts. If they send documentation, carefully review it and compare it to your own records.

If it turns out that you do owe the money, as the debt collector claims, you may be able to negotiate a partial payment or set up a payment plan with the collector.

If they say they’re going to sue you, you should take them seriously. A debt collector may not threaten to take any action that they are unable to take or do not intend to take under federal law.

If you’re unsure what to do next and the amount involved is significant enough, a debt collection attorney may be able to assist you.

Format of debt validation letter

The following is the format for your debt validation letter;

- Your Address

- Date

- collector’s address

- Subject line

- Salutation

- [opening paragraph]- A statement that you are writing to dispute the debt or to request additional information about the debt. (provide the details of the debt for easy reference)

- [body paragraphs]- state what additional information you require, or reasons to dispute the debt, etc

- [closing paragraphs] – call of action

- name and signature

Debt validation letter template (2022)

Your Name

Your Address

City, State, Zip Code

phone

email

DATE

[Collector’s Name]

[Collector’s Street Address]

[Collector’s City, State, and Zip Code]

Subject: [Including debt account number, if available]

Dear [Debt collector],

[Name of debt collector representative] contacted me on [date] by [phone or letter]. My debt to [name of creditor] was [dollar amount], according to the representative. I don’t owe that loan, though. I contested the account with [name of creditor] and the main credit bureaus since my information was stolen [when].

Please email me whatever evidence you have that I still owe this debt if you still think I am accountable for it. Please stop any communication with me until then and document that I deny any liability for this debt.

Tell the credit bureaus that I’m disputing this debt if you’re reporting this information or if you’ve already done so.

Regards

[Your name]

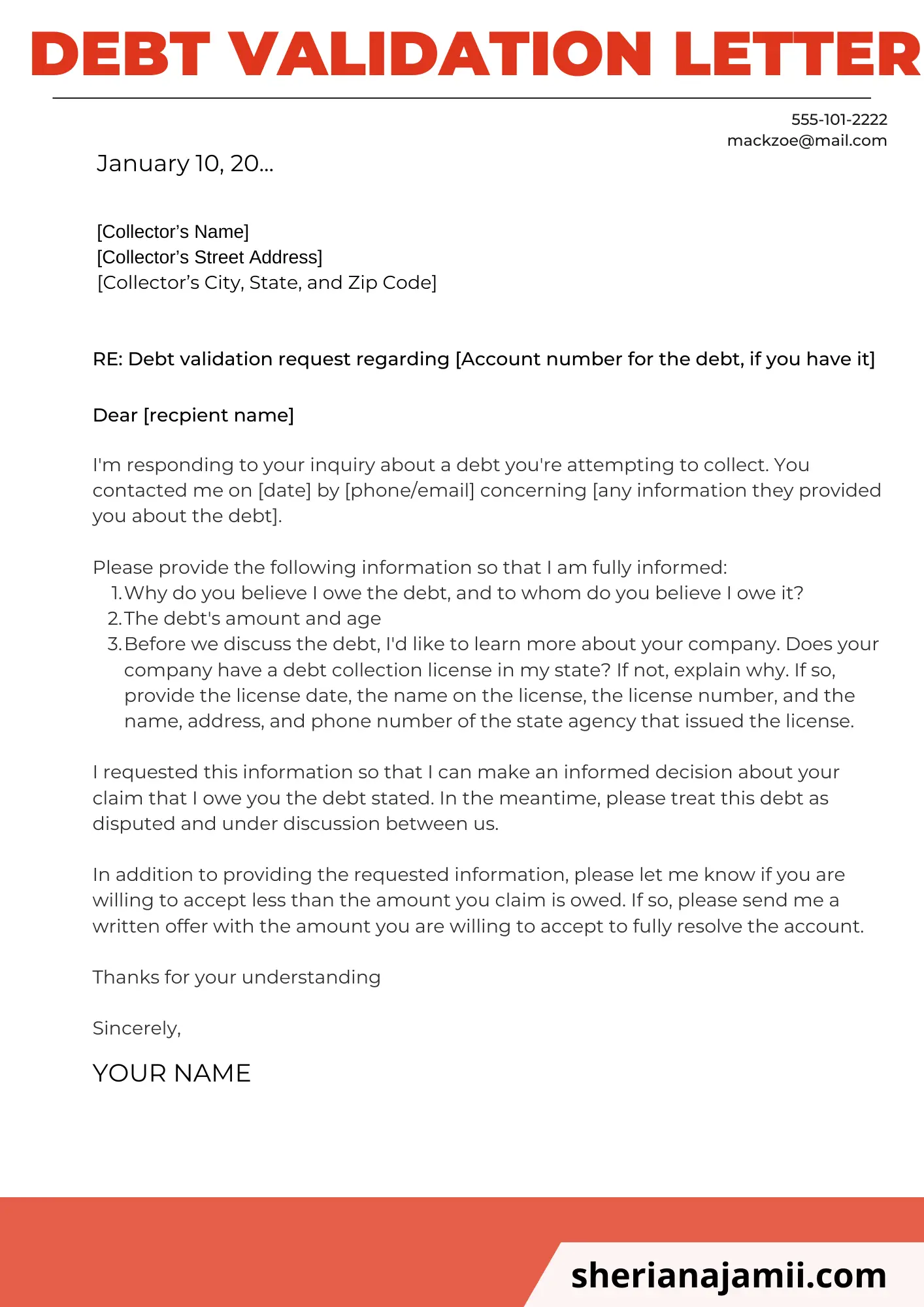

Sample of debt validation letter

The following is the debt validation letter template that shows how to dispute and request additional information concerning the debt owed.

Your Name

Your Address

City, State, Zip Code

phone

email

DATE

[Collector’s Name]

[Collector’s Street Address]

[Collector’s City, State, and Zip Code]

RE: Debt validation request regarding [Account number for the debt, if you have it]

Dear [recpient name]

I’m responding to your inquiry about a debt you’re attempting to collect. You contacted me on [date] by [phone/email] concerning [any information they provided you about the debt].

Please provide the following information so that I am fully informed:

- Why do you believe I owe the debt, and to whom do you believe I owe it?

- The debt’s amount and age

- Before we discuss the debt, I’d like to learn more about your company. Does your company have a debt collection license in my state? If not, explain why. If so, provide the license date, the name on the license, the license number, and the name, address, and phone number of the state agency that issued the license.

I requested this information so that I can make an informed decision about your claim that I owe you the debt stated. In the meantime, please treat this debt as disputed and under discussion between us.

In addition to providing the requested information, please let me know if you are willing to accept less than the amount you claim is owed. If so, please send me a written offer with the amount you are willing to accept to fully resolve the account.

Thanks for your understanding

Sincerely,

[Your name]

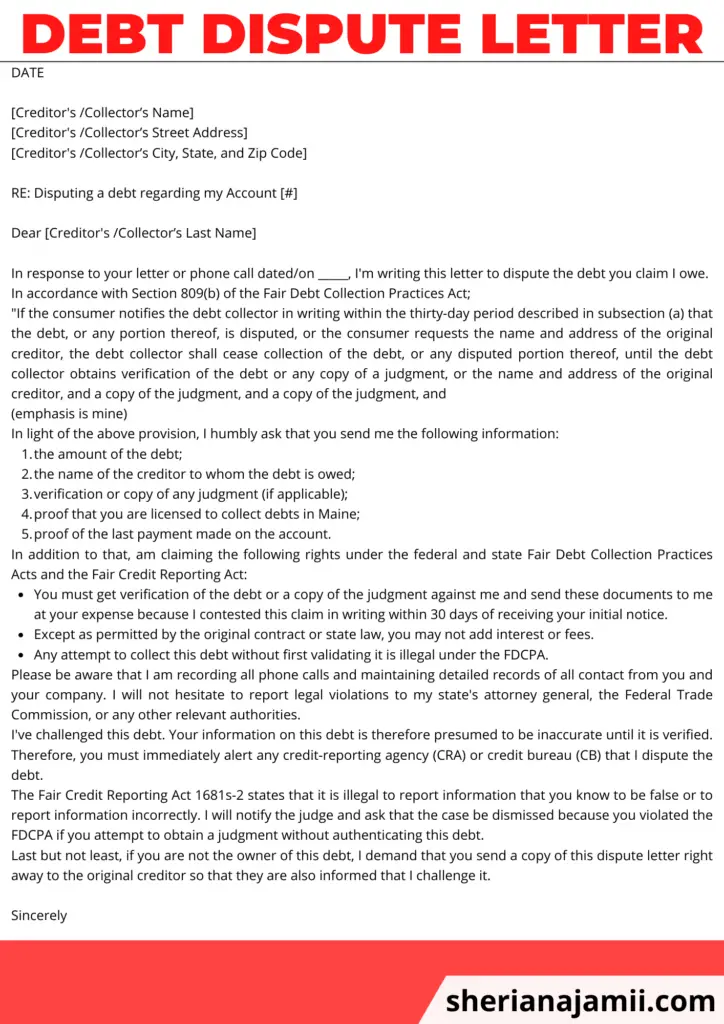

Debt dispute letter template

Your Name

Your Address

City, State, Zip Code

phone

email

DATE

[Creditor’s /Collector’s Name]

[Creditor’s /Collector’s Street Address]

[Creditor’s /Collector’s City, State, and Zip Code]

RE: Disputing a debt regarding my Account [#]

Dear [Creditor’s /Collector’s Last Name]

In response to your letter or phone call dated/on _____, I’m writing this letter to dispute the debt you claim I owe.

In accordance with Section 809(b) of the Fair Debt Collection Practices Act;

“If the consumer notifies the debt collector in writing within the thirty-day period described in subsection (a) that the debt, or any portion thereof, is disputed, or the consumer requests the name and address of the original creditor, the debt collector shall cease collection of the debt, or any disputed portion thereof, until the debt collector obtains verification of the debt or any copy of a judgment, or the name and address of the original creditor, and a copy of the judgment, and a copy of the judgment, and

(emphasis are mine)

In light of the above provision, I humbly ask that you send me the following information:

- the amount of the debt;

- the name of the creditor to whom the debt is owed;

- verification or copy of any judgment (if applicable);

- proof that you are licensed to collect debts in Maine;

- proof of the last payment made on the account.

In addition to that, am claiming the following rights under the federal and state Fair Debt Collection Practices Acts and the Fair Credit Reporting Act:

- You must get verification of the debt or a copy of the judgment against me and send these documents to me at your expense because I contested this claim in writing within 30 days of receiving your initial notice.

- Except as permitted by the original contract or state law, you may not add interest or fees.

- Any attempt to collect this debt without first validating it is illegal under the FDCPA.

Please be aware that I am recording all phone calls and maintaining detailed records of all contact from you and your company. I will not hesitate to report legal violations to my state’s attorney general, the Federal Trade Commission, or any other relevant authorities.

I’ve challenged this debt. Your information on this debt is therefore presumed to be inaccurate until it is verified. Therefore, you must immediately alert any credit-reporting agency (CRA) or credit bureau (CB) that I dispute the debt.

The Fair Credit Reporting Act 1681s-2 states that it is illegal to report information that you know to be false or to report information incorrectly. I will notify the judge and ask that the case be dismissed because you violated the FDCPA if you attempt to obtain a judgment without authenticating this debt.

Last but not least, if you are not the owner of this debt, I demand that you send a copy of this dispute letter right away to the original creditor so that they are also informed that I challenge it.

Sincerely

[Your name]

Debt dispute letter template pdf

![Sample letter to decline job offer [2025] 4 letter to decline job offer, sample letter to decline job offer](https://sherianajamii.com/wp-content/uploads/2025/01/letter-to-decline-job-offer-768x1086.png)

![Meeting cancellation notice 2025 [samples] 5 meeting cancellation notice, meeting cancellation notice sample, meeting cancellation notice examples, meeting cancellation notice template](https://sherianajamii.com/wp-content/uploads/2024/01/meeting-cancellation-notice-768x1086.png)

![Event cancellation notice due to weather 2025 [examples] 6 event cancellation notice due to weather , event cancellation notice due to weather examples](https://sherianajamii.com/wp-content/uploads/2024/01/event-cancellation-notice-due-to-weather--768x1086.png)