This post covers the shareholder agreement template

The pursue of this post s not to give you a template and go. No!

I want you to understand everything you need to know about shareholder agreements.

Here I will take you through

- what is a shareholder agreement

- why shareholder agreement is necessary

- Shareholder Agreement checklists

- Shareholders agreement template

- etc

let’s dive right in

What is a shareholder agreement

A shareholders’ agreement, sometimes known as a stockholders’ agreement, is a contract between shareholders that specifies how a business should be run and lays out the rights and obligations of each shareholder.

Information on the company’s management, shareholder rights, and protection is also included in the shareholder agreement.

Why shareholder agreement is necessary

There might be a lot of misunderstanding if there is no shareholder agreement because the shareholders’ agreement is meant to guarantee that shareholders receive fair treatment and have their rights upheld.

The agreement has parts describing the reasonable and appropriate share price (particularly when sold).

Additionally, it offers protections for minority positions and gives shareholders the ability to decide whether external parties may eventually become shareholders.

Shareholder Agreement checklists

The following are the points to be considered in drawing up shareholders’ agreements;

- Purpose of the company

- Capital, further finance, and funding support by the parties

- Appointment and maintenance in the office of directors

- Remuneration of directors

- Auditors and financial year

- Whether any of the parties are to have “fundamental” rights: for example in relation to borrowing above a certain level instance, material litigation, material contracts, change in the nature of the business, approval of a business plan, the creation of security over the assets of the company, changes in key personnel of a director, etc

- Confidentiality provisions

- Non-competition covenants by one or more of the promoters not to compete with the business of the company

- Covenant by one or more of the promoters not to dispose of any shares in the company for a specified period

- Payment of preliminary expenses

- The requirement that contracts entered into by one of the promoters with the company will be negotiated on an arm’s length basis and at a competitive price

Shareholders agreement template

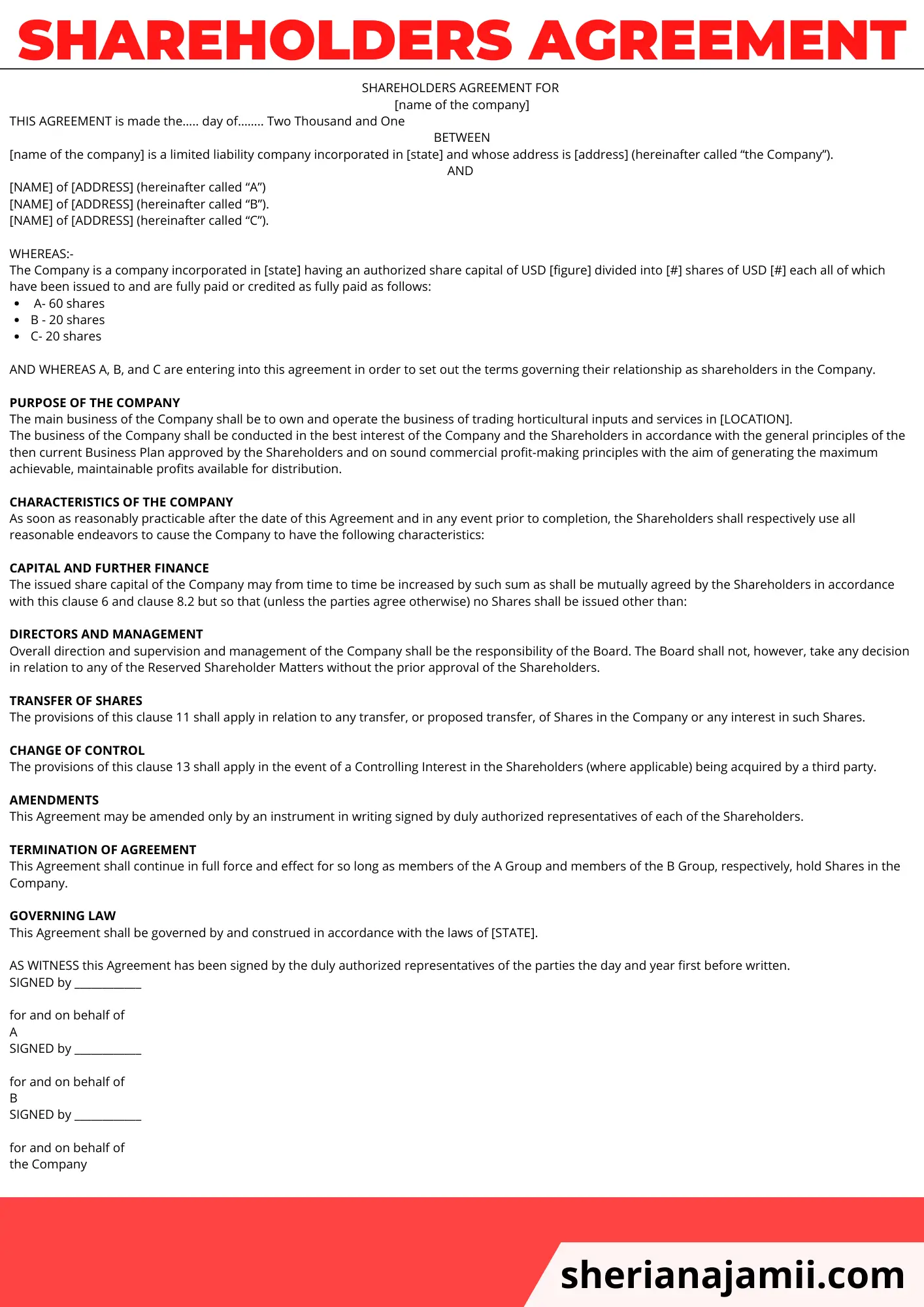

SHAREHOLDERS AGREEMENT FOR

[name of the company]

THIS AGREEMENT is made the….. day of……..

BETWEEN

[name of the company] is a limited liability company incorporated in [state] and whose address is [address] (hereinafter called “the Company”).

AND

[NAME] of [ADDRESS] (hereinafter called “A”)

[NAME] of [ADDRESS] (hereinafter called “B”).

[NAME] of [ADDRESS] (hereinafter called “C”).

WHEREAS:-

The Company is a company incorporated in [state] having an authorized share capital of USD [figure] divided into [#] shares of USD [#] each all of which have been issued to and are fully paid or credited as fully paid as follows:

- A- 60 shares

- B – 20 shares

- C- 20 shares

AND WHEREAS A, B, and C are entering into this agreement in order to set out the terms governing their relationship as shareholders in the Company.

NOW IT IS AGREED AS FOLLOWS:

INTERPRETATION

1.1 In this Agreement, the following expressions shall have the following respective meanings:

Board means the board of directors of the Company;

Budget means a budget for the Company for a particular Financial Year in a format approved from time to time by the Board;

Business means the business intended to be carried on by the Company, as described in clause 2;

Business Day means a day (other than a Saturday) on which banks generally are open in [STATE] for a full range of business;

Business Plan means a rolling business plan for the Company relating to the then-current Financial Year and four (4) succeeding Financial Years (in a format agreed from time to time between A, B, and C) to be updated annually;

Chairman means the chairman from time to time of the Board;

Company means Your Services Limited.

Completion means completion in accordance with clause 6;

Controlling Interest means

(i) the ownership or control (directly or indirectly) of more than fifty percent (50%) of the voting share capital of the relevant undertaking; or

(ii) the ability to direct the casting of more than fifty percent (50%) of the votes exercisable at general meetings of the relevant undertaking on all, or substantially all, matters; or

(iii) the right to appoint or remove directors of the relevant undertaking holding a majority of the voting rights at meetings of the board on all, or substantially all, matters;

A Directors means the directors of the Company from time to time appointed by the A Shareholder;

B Directors means the directors of the Company from time to time appointed by the B Shareholder;

Directors mean directors of the Company;

Equity Proportions means the respective proportions in which the issued ordinary share capital of the Company is held from time to time by the A Shareholders B Shareholders and the C Shareholders (initially being, in the case of the A Shareholders, 50%, in the case of B Shareholders 40% and, in the case of the C Shareholders, 10%;);

Fair Price means the open market value of the relevant Shares between a willing seller and a willing third party buyer at the date of the Transfer Notice without any premium or discount by reference to the percentage of the Shares being sold or transferred;

Financial Year means a financial period of the Company (commencing, other than in the case of its initial financial period, on ____________ and ending on ____________);

Group means, in relation to the Company or a party, that company and its Subsidiaries for the time being;

B Group means B and its Subsidiaries from time to time;

Insolvency Event has the meaning given to that expression in clause 21;

Intellectual Property rights means any patent, copyright, registered design, unregistered design right or other intellectual property protection in any part of the world, including any application for such protection, and all rights in any secret process, know‑how, or other confidential information;

Loans mean all loans, loan capital, borrowings, and indebtedness in the nature of borrowing (but excluding any debts which are or have been incurred in the ordinary course of trading);

Memorandum and Articles means the Memorandum and Articles of Association of the Company as amended from time to time;

Parties mean A, B, and C (and the party shall be construed accordingly);

Reserved Shareholder Matters means the matters so defined in clause 9;

Security Interest means any mortgage, charge, pledge, a lien (other than a lien arising by operation of law), right of set‑off, encumbrance, or any security interest whatsoever, howsoever created or arising, including any analogous security interest under local law;

Shareholders mean A, such members of B, and C as are for the time being holders of Shares (and Shareholder shall be construed accordingly);

A Shareholder(s) means the holder [or holders] for the time being of the A Shares;

B Shareholder(s) means the holder [or holders] for the time being of the B Shares;

C Shareholder(s) means the holder [or holders] for the time being of the C Shares;

A Shares means the 50 ordinary shares of K.Shs.20 each in the capital of the Company, together with any other ordinary shares in the issued capital of the Company issued to A from time to time;

B Shares means the 40 ordinary shares of K.Shs.20 each in the capital of the Company, together with any other ordinary shares in the issued capital of the Company issued to B from time to time;

C Shares means the 10 ordinary shares of K.Shs.20 each in the capital of the Company, together with any other ordinary shares in the issued capital of the Company issued to C from time to time;

Shares mean shares in the capital of the Company;

Subsidiary means, in relation to an undertaking (the holding undertaking), any other undertaking in which the holding undertaking (or persons acting on its or their behalf) for the time being directly or indirectly holds or controls either:

(a) a majority of the voting rights exercisable at general meetings of the members of that undertaking on all, or substantially all, matters; or

(b) the right to appoint or remove directors having a majority of the voting rights exercisable at meetings of the board of directors of that undertaking on all, or substantially all, matters and any undertaking which is a Subsidiary of another undertaking shall also be a Subsidiary of any further undertaking of which that other is a Subsidiary;

undertaking means a body corporate or partnership or an unincorporated association carrying on a trade or a business with or without a view to profit (and, in relation to an undertaking which is not a company, expressions in this Agreement appropriate to companies shall be construed as references to the corresponding persons, officers, documents or organs (as the case may be) appropriate to undertakings of that description).

Except where the context requires otherwise, references to clauses, Schedules are to clauses or Schedules of this Agreement, and references to sub‑clauses are to sub‑clauses of the clause in which the reference appears.

Headings are inserted for convenience only and shall not affect the construction of this Agreement or the Schedules.

Any reference to an agreed draft is to the form of the relevant document agreed between the parties and signed on their behalf for the purpose of identification before the signature of this Agreement (in each case with such amendments as may be agreed in writing between the parties).

Where any obligation pursuant to this Agreement is expressed to be undertaken or assumed by any party, such obligation shall be construed as requiring the party concerned to exercise all rights and powers of control over the affairs of any other person which that party is able to exercise (whether directly or indirectly) in order to secure performance of that obligation.

PURPOSE OF THE COMPANY

The main business of the Company shall be to own and operate the business of trading horticultural inputs and services in [LOCATION].

The business of the Company shall be conducted in the best interest of the Company and the Shareholders in accordance with the general principles of the then current Business Plan approved by the Shareholders and on sound commercial profit-making principles with the aim of generating the maximum achievable, maintainable profits available for distribution.

CHARACTERISTICS OF THE COMPANY

As soon as reasonably practicable after the date of this Agreement and in any event prior to completion, the Shareholders shall respectively use all reasonable endeavors to cause the Company to have the following characteristics:

3.1.1 The Company shall have an authorized share capital of USD [#] divided into [USD] shares with:

- 50 fully paid shares registered in the name of A and beneficially owned by A

- 40 fully paid shares registered in the name of B and beneficially owned by B

- 10 fully paid shares registered in the name of C and beneficially owned by C.

The Directors of the Company shall be the persons whose names are listed in clause 7.2.

The initial Chairman shall be …….

The initial Secretary shall be ……

CONDITIONS PRECEDENT

Completion of this Agreement shall be conditional upon the names of A, B, and C being entered in the register of the members of the Company as the respective holders of the Shares as stipulated in Clause 3.1.1 and that share certificates are issued to A, B, and C in respect of such Shares.

Each party shall use all reasonable endeavors to procure (so far as it lies within its respective powers so to do) that each of the conditions precedent as set out in clause 4.1 (to the extent that such conditions are not waived) are fulfilled as soon as possible.

If each of the conditions set out in Clause 4.1 shall not have been fulfilled or waived by ….. this Agreement shall unless the parties otherwise agree, thereupon automatically cease and terminate and neither party shall have any claim of any nature whatsoever against the other party, save in respect of any prior breach of the provisions of this Agreement.

COMPLETION

5.1 Completion shall take place at ____________________ on ____________ (or, if later, within ten (10) days after the fulfillment, or waiver, of all conditions precedent referred to in clause 4) when the events set out clause 4.1 shall take place.

5.2 If any party shall fail or be unable to comply with any of its obligations under clause 5.1, the other parties shall not be obliged to perform any of their respective obligations under clause 5.1 and the other parties shall be entitled to rescind this Agreement without liability on their part. Save as aforesaid, no party shall be entitled to rescind this Agreement, whether before or after Completion, for any reason whatsoever.

CAPITAL AND FURTHER FINANCE

6.1 The issued share capital of the Company may from time to time be increased by such sum as shall be mutually agreed by the Shareholders in accordance with this clause 6 and clause 8.2 but so that (unless the parties agree otherwise) no Shares shall be issued other than:

as to one‑half of such additional shares, as A Shares to A and/or a wholly‑owned Subsidiary of A;

as to one‑half of such additional shares,] as B Shares to B and/or a wholly‑owned Subsidiary of B; and

as to one‑half of such additional shares, as C Shares to C and/or a wholly‑owned Subsidiary of C.

It is the intention of the Shareholders that the Company should be self‑financing and should obtain additional funds from third parties without recourse to the Shareholders. No Shareholder shall be obliged to contribute further funds or participate for the benefit of the Company in any guarantee or similar undertaking. However, the parties acknowledge their intention to support the Company in accordance with the current Business Plan and will in good faith consider providing such guarantees and undertakings as may reasonably be required to ensure the adequate funding of the Company.

If the Board considers at any time that further finance is required for the Business, the Board will consider whether or not to approach the Company’s bankers or other financial institutions or, in appropriate circumstances, to seek such further finance from the parties. The parties will not be obliged to provide any such further finance unless both parties agree as to the amount and method by which such finance is to be provided. Unless otherwise agreed, any further contribution of finance to the Company (whether by way of subscription for shares, stock or debentures or by way of loan or otherwise) shall be made by each of them (or members of their respective Affiliates) in the same amount, at the same time and on the same terms.

Neither party (nor its Affiliates) shall be obliged to participate for the benefit of the Company in any guarantee, bond or financing arrangement with any bank or financial institution, whether as a guarantor or in any other capacity whatsoever. If and to the extent that the parties agree to participate (or agree to procure that their respective Affiliates participate) in any such guarantee, bond or financing arrangement then, unless the parties otherwise agree, any liability or obligation to be assumed by them in relation to any such guarantee, bond or financing arrangement shall be borne in their Equity Proportions. Any such liability or obligation shall, unless otherwise agreed, be several and not joint or joint and several and, in the event that a party (or its Affiliate) suffers any loss or damage resulting therefrom, that party shall be entitled to a contribution from the other party to ensure that the aggregate liability of the parties or members of their Affiliates (as the case may be) is borne by the A Group and the B Group in their Equity Proportions.

DIRECTORS AND MANAGEMENT

Overall direction and supervision and management of the Company shall be the responsibility of the Board. The Board shall not, however, take any decision in relation to any of the Reserved Shareholder Matters without the prior approval of the Shareholders.

The Board shall be comprised of an equal number of A Directors and B Directors. Unless otherwise agreed by the Shareholders, there shall be one (1) A Director and one (1) B Director. The initial appointments to the Board as at Completion shall be as follows:

- Managing Director – …………..

- Financial Director – ……….

Any appointment or removal of a Director nominated by a party shall be effected by notice in writing to the Company signed by or on behalf of the party in question and shall take effect, subject to any contrary intention expressed in the notice when the notice effecting the same is delivered to the Company.

The quorum for the transaction of business at any meeting of the Board (other than an adjourned meeting) shall be at least one A Director and at least one B Director present at the time when the relevant business is transacted. If such a quorum is not present within thirty (30) minutes from the time appointed for the meeting or if during the meeting such a quorum ceases to be present, the meeting shall be adjourned for seven (7) Business Days and at that adjourned meeting any two (2) Directors (or their alternates) present shall constitute a quorum. A Director shall be regarded as a present for the purposes of a quorum if represented by an alternate Director in accordance with clause

7.6. At least [# days] written notice shall be given to each of the members of the Board of any meeting of the Board, provided always that a shorter period of notice may be given with the written approval of [at least one A Director (or his alternate) and at least one B Director (or his alternate)]. Any such notice shall contain, inter alia, an agenda identifying in reasonable detail the matters to be discussed at the meeting and shall be accompanied by copies of any relevant papers to be discussed at the meeting. Any matter which is to be submitted to the Board for a decision which is not identified in reasonable detail as aforesaid shall not be decided upon, unless otherwise agreed in writing by [all of the members of the Board].

7.7 Matters for decision by the Board shall [(subject to clause 7.7)] be decided by simple majority vote. Each Director shall have one vote [except that the Chairman shall have an additional vote exercisable in accordance with the terms of clause 7.7].

Any Director who is absent from any meeting may nominate any other Director to act as his alternate and to vote in his place at the meeting. [If the parties are not represented at any meeting of the Board by an equal number of Directors (whether present in person or by an alternate), then one of the Directors, so present nominated by the party which is represented by the fewer Directors, shall be entitled at that meeting to such additional vote or votes as shall result in the Directors so present representing each party having [(subject to clause 8.7)] in aggregate an equal number of votes.]

[Chairman’s additional vote].

RESERVED MATTERS

8.1 The parties shall use their respective powers to procure, so far as they are legally able, that no action or decision relating to any of the matters specified in clause 8.2 (Reserved Shareholder Matters) shall be taken (whether by the Board, the Company or any Subsidiary of the Company or any of the officers or managers within the Company) unless prior approval to proceed has been given by each of the Shareholders.

8.2 The Reserved Shareholder Matters are the following:

adoption of or any alteration to the Memorandum and Articles or other constitutional documents of the Company;

any change in the authorized or issued share capital of the Company or any increase (or reduction) by the Company in its shareholding in any other company;

any material change in the nature or scope of the Business (as described in clause 2.1) of the Company; (adoption of the Business Plan and Budgets referred to in clause ___;

the declaration or payment of any dividend or distribution by the Company;

any borrowing or raising of money by the Company (which would result in the aggregate borrowing of the Company exceeding ____ (or such other amount as the parties shall from time to time agree)];

capital expenditure by the Company in respect of any item or project in excess of ____ or such other sum as may be agreed between the parties from time to time;

any acquisition or disposal (whether in a single transaction or series of transactions) by the Company of any business (or any material part of any business) or of any shares in any company; (except for contracts which satisfy such authorization criteria as the Shareholders may from time to time approve as part of the procedures for the entry into of contracts by the Company the entry into by the Company of any contract, liability or commitment which:

is of a long term (long-term meaning, for this purpose, having a duration in excess of two (2) calendar years) or unusual nature; or

could involve an obligation of a material magnitude or nature (a liability for expenditure in excess of ____ being regarded as material for this purpose); or

is outside the ordinary course of business of the Company;

major decisions relating to the conduct (including the settlement) of material legal proceedings to which the Company is a party (a potential liability, or claim, in excess of ____ being regarded as material for these purposes);

the appointment or removal of persons nominated as the Managing Director, Financial Controller, Research and Development Manager or the Secretary of the Company;

the creation of any mortgage, charge, encumbrance or other security interest of whatsoever nature in respect of all or any material part of the undertaking, property or assets of the Company;

the appointment or removal of the auditors of the Company;

the approval of the statutory accounts of the Company and any change in the principal accounting policies of the Company;

the formation of policies for the Company in respect of business conduct, the environment and health and safety issues;

any material acquisition or disposal by the Company (including any material acquisition or grant of any licence) of or relating to any Intellectual Property Rights;

any proposal that Company be wound‑up.

The approval of the Shareholders to any of the Reserved Shareholder Matters (or to any variation thereof) shall be given by representatives of the Shareholders at a general meeting of the Company.

General meetings of Shareholders shall take place in accordance with the applicable provisions of the Articles on the basis (inter alia) that:

a quorum shall be one (1) duly authorised representative of the A Shareholder(s), one (1) duly authorised representative of the B Shareholder(s) and one (1) duly authorised representative of the C Shareholder(s);;

the notice of meeting shall (unless otherwise agreed by each of the Shareholders) set out an agenda identifying in reasonable detail the matters to be discussed;

the chairman of any such meeting shall [not] have a casting vote;

a decision to approve any of the Reserved Shareholder Matters shall require a unanimous vote of all the Shareholders.

Any matters requiring a general meeting of or approval by the Shareholders under relevant corporate laws, but not covered by the Reserved Shareholder Matters, shall be dealt with in accordance with the Memorandum and Articles.

If a deadlock arises by reason of a failure by the parties to reach an agreement on any of the Reserved Shareholder Matters or any other management matter requiring decision by the parties, each party shall endeavor to resolve any disagreement in the best interests of the Company.

FINANCIAL MATTERS

9.1 The auditors of the Company shall be ____________ or such other firm of accountants of recognized standing as may be agreed by the Shareholders from time to time.

9.3 [The Financial Year of the Company shall be, unless otherwise agreed by the parties, ____________.

9.4 The parties shall, unless otherwise agreed between them in relation to any Financial Year, take all steps to procure that there shall be distributed in respect of each Financial Year such percentage as the parties may from time to time agree in writing of the profit (after taxation and extraordinary items) of the Company as shown by the financial statements of the Company for that Financial Year and available for distribution in accordance with applicable law.

The constitutional documents of the Company shall, wherever legally permitted, make provision for the payment of interim dividends.

INFORMATION AND REPORTING

10.1 Each of the Shareholders shall be entitled to examine the separate books, records and accounts to be kept by the Company and to be supplied with all information, including monthly management accounts and operating statistics and other trading and financial information, in such form as the Board shall determine to keep each party properly informed about the business and affairs of the Company and generally to protect its interests as a Shareholder.

10.2 The parties shall, in any event and without prejudice to the generality of clause 10.1, be supplied by the Company with copies of:

audited accounts for the Company;

a Business Plan and itemised revenue and capital Budgets for each Financial Year of the Company and showing proposed trading and cash flow figures, manning levels and all material proposed acquisitions, disposals and other commitments for such Financial Year; and

monthly/quarterly management accounts of the Company.

TRANSFER OF SHARES

11.1 The provisions of this clause 11 shall apply in relation to any transfer, or proposed transfer, of Shares in the Company or any interest in such Shares.

Except as permitted by this clause 11 or with the prior written consent of the other Shareholders, no Shareholder shall:

- transfer any Shares; or

- grant, declare, create or dispose of any right or interest in any Shares; or

- create or permit to exist any pledge, lien, charge (whether fixed or floating) or other encumbrance over any Shares.

Save for transfers for which consent is given under clause 11.2 or for intra‑Group transfers permitted under clause 11.13, no Shares held by any Shareholder may be transferred otherwise than pursuant to a transfer by that party (the Seller) of the Shares held by it (the Seller’s Shares).

Before the Seller makes any transfer of the Seller’s Shares, the Seller shall first give to the other Shareholders (the Continuing Parties) notice in writing (a Transfer Notice) of any proposed transfer together with details of the proposed third party purchaser thereof (the Third Party Purchaser), the purchase price and other material terms agreed between the Seller and the Third Party Purchaser. A Transfer Notice shall, except as hereinafter provided, be irrevocable.

On receipt of the Transfer Notice, the Continuing Parties shall have the right to purchase all (but not some only) of the Seller’s Shares in the proportion of their Equity Proportions at the purchase price specified in the Transfer Notice (or at such other price as shall be agreed between the Seller and the respective Continuing Parties) by giving written notice to the Seller within sixty (60) days of receipt of the Transfer Notice (the Acceptance Period). The obligations of the parties to complete such purchase shall be subject to the provisions of clause 11.9.

11.6 If any or both of the Continuing Parties wishes to purchase the Seller’s Shares but is unwilling to accept the price specified in the Transfer Notice and fails to agree a price with the Seller within the Acceptance Period, then that Continuing Party shall be entitled to refer the question of the purchase price to a firm of accountants (the Expert) agreed upon by the Seller and the Continuing Party to certify the Fair Price thereof. The following principles shall apply:

(a) the Expert shall, unless otherwise agreed between the parties, be a firm which is independent of both parties and which shall not have acted for either party in any material capacity for a period of at least two (2) years preceding the date of the Transfer Notice;

(b) if the Seller and the Continuing Party are unable to agree upon such firm within a period of fifteen (15) days after the expiry of the Acceptance Period, then the Expert shall be appointed by the Chairman for the time being of Institute of Certified Public Accountants of [STATE]

(c) the parties shall procure that there is made available to the Expert such information relating to the Company as it reasonably requires in order to determine the Fair Price

(d) in certifying the Fair Price, the Expert shall take into account all factors it considers to be relevant, including the purchase price and other material terms agreed between the Seller and the Third Party Purchaser;

(e) the Expert shall be deemed to be acting as an expert and not an arbitrator and its decision shall be final and binding on the parties;

(f) the cost of obtaining the Expert’s certificate (the Certificate) shall be borne by the parties equally unless the Seller shall give notice of revocation pursuant to clause 18.8, in which case the Seller shall bear the said cost.

11.7 If the Seller is not willing to accept the Fair Price determined by the Expert, then it shall be entitled to revoke the Transfer Notice by notice in writing given within a period of thirty (30) days after the date of the issue of the Certificate (which, for the avoidance of doubt, shall be issued to both the Seller and the Continuing Party). In the event of such revocation, the Seller shall not be entitled to transfer the Seller’s Shares or any of them without first serving a further Transfer Notice and otherwise complying with this clause.

11.8 If the Transfer Notice shall not have been duly revoked under clause 11.7, the Continuing Party shall have the right to purchase from the Seller the Seller’s Shares at the Fair Price by giving written notice to the Seller within thirty (30) days of the expiry of the period of thirty (30) days mentioned in clause 11.7.

11.9 The Continuing Party shall become bound (subject only to any necessary approvals of its shareholders in general meeting) to purchase the Seller’s Shares on giving written notice to the Seller to exercise its rights under either of clauses 11.2 or 11.8. In such event, completion of the sale and purchase of the Seller’s Shares shall take place within thirty (30) days after the giving of such notice or, if later, the obtaining of any shareholder approval. Notwithstanding the foregoing, such notice and right of the Continuing Party to acquire the Seller’s Shares shall cease to have effect if any necessary approval of the Continuing Party’s shareholders in general meeting has not been obtained within the said period of thirty (30) days.

11.10 If the Continuing Party does not exercise its rights of purchase under clauses 11.2 or 11.8 or any notice given thereunder ceases to have effect pursuant to clause 11.9, the Seller shall (subject to clause 11.12 below) be entitled to transfer the Seller’s Shares on a bona fide arm’s length sale to a Third Party Purchaser at a price being not less than the purchase price specified in the Transfer Notice (or, if lower, any Fair Price determined by the Expert) provided that:

(a) the Third Party Purchaser (or any shareholder therein) is not directly or indirectly a substantial competitor of the Company; and

(b) such transfer shall have been completed within a period of one‑hundred and eighty (180) days after the latest of: (i) the date of the Transfer Notice or (ii) if the question of the purchase price shall have been referred to the Expert, the issue of the Certificate or (iii) if any notice given by the Continuing Party shall have ceased to have effect pursuant to clause 18.9, the date on which such notice ceased to have effect.

The parties undertake to give (or procure that any Shareholders in their Group give) such approvals as may be required under the provisions of the Articles to any transfer of Shares permitted by the terms of this clause 11.

11.12 Completion of any transfer of Shares to a Third Party Purchaser shall be subject to the conditions that:

(a) the Third Party Purchaser shall first have entered into an agreement with the Continuing Party whereby it agrees to be bound (in terms reasonably satisfactory to the Continuing Party) by provisions corresponding to provisions of this Agreement binding upon the Seller;

(b) any loans, loan capital, borrowings and indebtedness in the nature of borrowing (but excluding, for the avoidance of doubt, any debts incurred in the ordinary course of trade which are at the relevant time outstanding on inter‑company account) owing at that time from the Company to the Seller shall first have been assigned to, or equivalent finance made available by, the Third Party Purchaser; and

(c) if and insofar as the Seller requires the Third Party Purchaser to assume the obligations of the Seller under any guarantees and/or counter‑indemnities to third parties in relation to the business of the Company, such assumption shall first have taken place (provided that any such assumption is without prejudice to the right of the Continuing Party to receive a contribution from the Seller for its share of any claims attributable to any liabilities arising in respect of the period during which the Seller held Shares).

A Shareholder shall be entitled at any time to transfer any of the Shares held by it to a company which (in the case of a transfer by one of the parties itself) is a wholly‑owned Subsidiary of that party.

Each of A and B respectively undertakes to procure that, if any Shareholder in its Group ceases at any time to be a wholly‑owned Subsidiary of the relevant party, such Subsidiary prior to so ceasing shall transfer all of the Shares held by it at the time in question to the party of which it is a Subsidiary or to a wholly‑owned Subsidiary of that party.

The Seller shall use all reasonable endeavours (but without involving any financial obligation on its part) to procure that the Transfer Notice given by it under clause 18.4 shall be accompanied by an offer to the Continuing Party from the Third Party Purchaser to purchase all the Shares held by the Continuing Party on the same terms (including price per Share) as are set out in the Transfer Notice, which offer shall be expressed to be (i) irrevocable, (ii) governed by [STATE] law and (iii) open for acceptance by the Continuing Party during the Acceptance Period. If the Transfer Notice is not accompanied by such an offer:

(a) the Acceptance Period for the purposes of clause 18.5 shall, notwithstanding the terms of clause 18.5, be extended to a period of one hundred and eighty (180) days from the date of receipt of the Transfer Notice

(b) the Seller shall use all reasonable endeavours during the extended Acceptance Period (but without involving any financial obligation on its part) to procure that the Third Party Purchaser shall make an offer to the Continuing Party as aforesaid and that the Continuing Party shall be enabled to participate fully at its own expense in all negotiations and discussions between the Seller and the Third Party Purchaser or their respective agents; and

(c) subject to any obligations of confidentiality owed to third parties, the Seller shall permit the Continuing Party to have full access to all documents and information in the possession or under the custody and control of the Seller directly or indirectly relating to the intended transfer of the Seller Shares to the Third Party Purchaser and which the Continuing Party may require in connection with such negotiations and discussions.

CHANGE OF CONTROL

The provisions of this clause 13 shall apply in the event of a Controlling Interest in the Shareholders (where applicable) being acquired by a third party.

If a Controlling Interest in the relevant Shareholder (the Changed Party) is acquired by a third party (such party being herein termed the Changed Party), then at any time prior to the expiry of a period of ninety (90) days after such acquisition, the other Shareholders (the Buyer) shall be entitled to make an offer in respect of all the Shares and Loans (the Relevant Securities) collectively held by the Changed Party and/or any members of its Group).

The offer for the Relevant Securities referred to in clause 13.2 shall take the form of a notice to the Changed Party (the Offer Notice). Included in such Offer Notice shall be the price offered (the Offered Price) and a statement that the offer is to be accepted within a period of thirty (30) days of receipt of the Offer Notice.

If the Changed Party notifies the Buyer within the said thirty (30) day period that it does not accept the Offered Price or fails to respond to the Buyer within such period, a recognised firm of accountants (the Expert) shall be appointed to determine the Fair Price. The Expert shall be such recognised firm of accountants as the parties may agree or, failing such agreement within fifteen (15) days of the expiry of the period of thirty days (30) aforesaid, the Expert shall be such recognised firm of accountants, independent of both of the parties, as is appointed for the purpose by the Chairman of the Institute of the Chratered Accountants of [STATE] at the request of the Changed Party. Any such request shall be made within fifteen (15) days of the expiry of the period of fifteen (15) days aforesaid (or such longer period as the parties may in writing agree). If the Changed Party fails to make such a request, it shall be deemed to have accepted the Offered Price. The Expert shall act as an expert and not as an arbitrator and its decision, which shall be incorporated in a certificate (the Certificate), shall be final and binding on the parties. The fees charged and expenses claimed by the Expert shall be borne by the parties equally.

If an appointment of the Expert is made under clause 13.4, the Buyer shall have the right to purchase the Relevant Securities from the Changed Party (in proportion to their respective Equity proportions) at the Fair Price and the Buyer shall exercise such right of purchase by giving written notice to the Changed Party within thirty (30) days of the issue of the Certificate (which, for the avoidance of doubt, shall be issued by the Expert to both the Changed Party and the Buyer).

Subject only to any approval of the shareholders of the Buyer in general meeting (Approvals), the Changed Party shall become bound to sell and the Buyer shall become bound to purchase the Relevant Securities:

(a) at the Offered Price, if the Changed Party gives written notice of acceptance of the Offered Price under clause 13.3; or

(b) at the Offered Price, if the Changed Party fails to request the Expert to determine the Fair Price within the second period of fifteen (15) days referred to in clause 13.4; or

(c) at the Fair Price, if the Buyer gives written notice of the exercise of its rights under clause 13.5.

In such event, completion of the sale and purchase of the Offered Shares shall take place within sixty (60) days of the day on which the parties become so bound (the Reference Date) or, if any Approval has not been obtained by the expiry of that period, within ten (10) days of the date on which the last Approval to be obtained is obtained provided that, if any such Approval has not been obtained within one‑hundred and eighty (180) days after the Reference Date, the Offer Notice shall lapse and be without further effect.

13.7 Completion of any transfer of the Relevant Securities shall be subject to the condition that the Buyer shall have assumed the obligations of the Changed Party under any guarantees and/or counter‑indemnities to third parties in relation to the business of the Company. Such assumption is without prejudice to the right of the Buyer to receive a contribution from the Changed Party for its share of any claims attributable to any liabilities arising in respect of the period during which the Changed Party and/or any members of its Group held Relevant Securities.

INSOLVENCY AND DEFAULT

14.1 It shall be an Insolvency Event in relation to a party if:

(a) an order is made by a court of competent jurisdiction, or a resolution is passed, for the dissolution or administration of that party (otherwise than in the course of a reorganisation or restructuring previously approved in writing by the other party, such approval not to be unreasonably withheld or delayed); or

(b) any step is taken by any person other than a member of the other party’s Group (and not withdrawn or discharged within ninety (90) days) to appoint a liquidator, manager, receiver, administrator, administrative receiver or other similar officer in respect of any assets which include either (i)] the Shares held by that party or any Subsidiary thereof or (ii) shares in that party or any holding company thereof; or

(c) that party convenes a meeting of its creditors or makes or proposes any arrangement or composition with, or any assignment for the benefit of, its creditors; or

(d) that party does not pay within thirty (30) Business Days of the due date any amount payable by it under this Agreement in the manner in which it is expressed to be payable in this Agreement; and reference to a party in this clause (other than any reference to the other party) shall include any Shareholder in that party’s Group or any holding company of that party.

14.2 If an Insolvency Event shall occur in relation to a party (the Affected Party), the Affected Party shall be deemed to be a Seller which has given a Transfer Notice under clause 11.5 and the other party shall have the right, as therein provided, to purchase the Affected Party’s investment at such price as shall be agreed between the Affected Party and the other party or the Fair Price determined in accordance with clause 11.7.

If a party (or any member of its Group) commits a breach of any of the provisions of this Agreement (the Defaulting Party), the other party may serve notice upon the Defaulting Party specifying such breach and requiring the Defaulting Party immediately to cease such breach and to make good within ninety (90) days the results of such breach to the extent that such is possible. This shall not affect the other party’s right subsequently to claim damages or other compensation under applicable law for the breach in question or, where appropriate, to seek an immediate remedy of an injunction, specific performance or similar court order to enforce the obligations of the Defaulting Party.]

FURTHER ASSURANCES

15.1 Each Shareholder undertakes with the other that (so far as it is legally able) it will exercise all voting rights and powers, direct and indirect, available to it in relation to any person and to the Company so as to ensure the complete and punctual fulfilment, observance and performance of the provisions of this Agreement (and the other Agreements referred to in this Agreement) and generally that full effect is given to the principles set out in this Agreement.

15.2 Each Shareholder shall procure the performance by its Subsidiaries of all obligations under this Agreement which are expressed to relate to members of its respective Group (whether as Shareholders or otherwise) and of all obligations under any agreement entered into by any of its Subsidiaries pursuant to this Agreement. The liability of a party under this clause 15.2 shall not be discharged or impaired by any amendment to or variation of this Agreement, any release of or granting of time or other indulgence to any of its Subsidiaries or any third party or any other act, event or omission which but for this clause would operate to impair or discharge the liability of such party under this clause 15.2.

NON‑ASSIGNMENT

16.1 Neither Shareholder, nor the Company may assign any of its rights or obligations under this Agreement in whole or in part (otherwise than pursuant to a transfer of Shares to a third party in accordance with the terms of this Agreement).

17 WAIVER OF RIGHTS

17.1 No waiver by a party of a failure by the other party to perform any provision of this Agreement shall operate or be construed as a waiver in respect of any other failure whether of a like or different character.

AMENDMENTS

This Agreement may be amended only by an instrument in writing signed by duly authorised representatives of each of the Shareholders.

INVALIDITY

19.1 If any of the provisions of this Agreement is or becomes invalid, illegal or unenforceable, the validity, legality or enforceability of the remaining provisions shall not in any way be affected or impaired. The parties shall nevertheless negotiate in good faith in order to agree the terms of a mutually satisfactory provision, achieving as nearly as possible the same commercial effect, to be substituted for the provision so found to be void or unenforceable.

NO PARTNERSHIP OR AGENCY

Nothing in this Agreement (or any of the arrangements contemplated by this Agreement) shall be deemed to constitute a partnership between the parties nor, save as may be expressly set out herein, constitute either party the agent of the other party for any purpose.

In addition, unless otherwise agreed in writing between the parties, neither of them shall enter into any contracts or commitments with third parties as agent for the Company or for the other party nor shall either party describe itself as such an agent or in any way hold itself out as being such an agent.

ANNOUNCEMENTS

No formal public announcement or press release in connection with the signature or subject matter of this Agreement shall (subject to clause 21.2) be made or issued by or on behalf of either party or any of its Subsidiaries without the prior written approval of the other party (such approval not to be unreasonably withheld or delayed).

If a party has an obligation to make or issue any announcement required by law or by any stock exchange or by any governmental authority, the relevant party shall give the other party every reasonable opportunity to comment on any such announcement or release before it is made or issued (provided always that this shall not have the effect of preventing the party making the announcement or release from complying with its legal and stock exchange obligations.)

COSTS

22.1 Each of the parties shall, pay its own legal and accountancy costs, charges and expenses (including taxation) incurred in connection with the negotiation, preparation and implementation of this Agreement and the transactions contemplated by it

ENTIRE AGREEMENT

23.1 This Agreement and any other Agreements entered into on Completion pursuant to clause 6 set out the entire agreement and understanding between the parties with respect to the subject matter hereof. It is agreed that:

(a) neither party has entered into this Agreement in reliance upon any representation, warranty or undertaking of the other party which is not expressly set out or referred to in this Agreement;

(b) a party may claim in contract for breach of warranty under this Agreement but otherwise shall have no claim or remedy in respect of misrepresentation (whether negligent or otherwise) or untrue statement made by the other party;

(c) this clause shall not exclude any liability for fraudulent misrepresentation.

CONFLICT WITH ARTICLES

In the event of any conflict between the provisions of this Agreement and the Memorandum and Articles or another constitutional document of the Company, the provisions of this Agreement shall prevail as between the parties. The parties shall exercise all voting and other rights and powers available to them so as to give effect to the provisions of this Agreement and shall further (if necessary) procure any required amendment to the Memorandum and Articles or another constitutional document of the Company (as may be necessary).

Without prejudice to the generality of clause 24.1, the parties confirm their intention that the provisions of this Agreement shall prevail in relation to the transfer of Shares and, accordingly, that:

(a) the provisions of the Articles of the Company shall not be used by either party to frustrate the operation of the relevant clauses of this Agreement; and

(b) each party will promptly give (or procure that any Shareholder in its Group promptly gives) any approval necessary or appropriate under its Articles in order to give full and immediate effect to the procedure contemplated by the provisions of this Agreement and/or any transfer of Shares permitted hereunder.

24.3 The Company shall not be bound by any provision of this Agreement to the extent that it would constitute an unlawful fetter on any statutory power of the Company (but this shall not affect the validity of the relevant provision as between the other parties to this Agreement or the respective obligations of such other parties as between themselves under clause 24.1.

TERMINATION OF AGREEMENT

25.1 This Agreement shall continue in full force and effect for so long as members of the A Group and members of the B Group, respectively, hold Shares in the Company.

25.2 This Agreement shall also terminate upon a resolution being passed for the winding‑up of the Company. In such event, the Shareholders and the Company shall endeavour to agree on a suitable basis for dealing with the interests and assets of the Company but subject thereto:

(a) A and B shall co‑operate (but without any obligation to provide any additional finance) with a view to enabling all existing trading obligations of the Company to be completed insofar as its resources allow. A and B shall consult together with a view to outstanding contracts within the Business being novated or re‑allocated in a suitable manner

(b) no new contractual obligation for the supply of products or services shall be assumed by the Company;

(c) unless otherwise agreed between A and B, the parties shall procure that the Company shall as soon as practicable be wound up;

25.3 After termination of this Agreement if the Company is not placed into liquidation, or upon either A or B ceasing or being about to cease to be a Shareholder or to have any of its Subsidiaries as a Shareholder, each party shall on the request of the other exercise its powers with a view to procuring that the name of the Company is changed so as no longer to include the name, initials or trade mark or any reference to the name, initials or trademark of the party making such request.

NOTICES

26.1 Any notice or other formal communication to be given under this Agreement shall be in writing and signed by or on behalf of the party giving it and may be served by leaving it or sending it by fax, delivering it by hand or sending it by first class post to the address and for the attention of the relevant party set out in clause 26.2 (or as otherwise duly notified from time to time). Any notice so served by hand, fax or post shall be deemed to have been received:

(a) in the case of delivery by hand, when delivered;

(b) in the case of fax, twelve (12) hours after the time of despatch;

(c) in the case of post, at the expiration of [________ (________)] Business Days after the envelope containing the same was delivered into the custody of the postal authorities

provided that, where, (in the case of delivery by hand or by fax), such delivery or transmission occurs after 6 pm on a Business Day or on a day which is not a Business Day, service shall be deemed to occur at 9 am on the next following Business Day. References to time in this clause are to local time in the country of the addressee.

26.2 The addressees of the parties for the purpose of clause 26.1 are as follows:

(a) A:

Address:

Fax No:

Addressed for the personal attention of:

(b) B:

Address:

Fax No:

Addressed for the personal attention of:

(c) B:

Address:

Fax No:

Addressed for the personal attention of:

In proving such service it shall be sufficient to prove that the envelope containing such notice was properly addressed and delivered either to the address shown thereon or into the custody of the postal authorities as a pre‑paid first class letter or that the fax was sent after obtaining in person or by telephone appropriate evidence of the capacity of the addressee to receive the same, as the case may be.

All notices or formal communications under or in connection with this Agreement shall be in the English language or, if in any other language, accompanied by a translation into English. In the event of any conflict between the English text and the text in any other language, the English text shall prevail.

SETTLEMENT OF DISPUTES

27.1 In the event of any dispute between the Shareholders arising in connection with this Agreement or any associated agreement entered into pursuant to this Agreement, the disputing parties shall use all reasonable endeavours to resolve the matter on an amicable basis. If one party serves formal written notice on the other that a material dispute of such a description has arisen and the parties are unable to resolve the dispute within a period of thirty (30) days from the service of such notice, then the dispute shall be referred to arbitration. This shall not affect a party’s right, where appropriate, to seek an immediate remedy for an injunction, specific performance or similar court order to enforce the obligations of the other party.

27.8 Any dispute arising out of or in connection with this Agreement shall be referred to and finally settled by arbitration under Arbitration Act 1995 and the rules made thereunder by one arbitrator appointed in accordance with those Rules. The place of arbitration shall be Nairobi in the Republic aforesaid. The language of arbitration proceedings shall be English.

COUNTERPARTS

28.1 This Agreement may be executed in any number of counterparts and by the parties to it on separate counterparts, each of which shall be an original, but all of which together shall constitute one and the same instrument.

GOVERNING LAW

29.1.This Agreement shall be governed by and construed in accordance with the laws of [STATE].

AS WITNESS this Agreement has been signed by the duly authorized representatives of the parties the day and year first before written.

SIGNED by ____________

for and on behalf of

A

SIGNED by ____________

for and on behalf of

B

SIGNED by ____________

for and on behalf of

the Company

![How long it takes to become a lawyer? [timeline breakdown] 4 How long it takes to become a lawyer, timeline to become a lawyer, timeline of becoming a lawyer](https://sherianajamii.com/wp-content/uploads/2023/01/How-long-it-takes-to-become-a-lawyer-768x576.png)