This post covers everything you need to know about the Letter of testamentary California.

Here you will learn;

- What is a Letter of testamentary California

- How do I get a letter of testamentary in California?

- How long do you have to file probate after death in California?

- How much do letters of testamentary cost in California?

- etc.

Let’s dive right in

What is a Letter of testamentary California

Transform Your Communication, Elevate Your Career!

Ready to take your professional communication skills to new heights? Dive into the world of persuasive business correspondence with my latest book, “From Pen to Profit: The Ultimate Guide to Crafting Persuasive Business Correspondence.”

What You’ll Gain:

A letter of testamentary in California is a legal document issued by the superior court in a county once the correct petition is filed and approved for the purpose of appointing an Executor of the estates of a person who dies testate (leaving a Will).

Through a letter of testamentary, the court appoints a person, usually, an executor named in the will, as a personal representative to collect the assets, pay the debts and expenditures, and then distribute the remaining estate to the beneficiaries (those who have the legal right to inherit), all while under the supervision of the court.

In California, the letter of testamentary is applicable only to the decedent estates that exceed $166,250.

NB: ‘Letters of testamentary’ is not the same as regular letters. In legal parlance, the term “letters” refers to “mandate, authority, and command.”

People get confused because they’ll go to a bank and the bank will say, “Well, you need Letters,” and then they’ll call a lawyer and say, “Can you write me a letter, I need a letter,”

Listen! this is not that type of letter, it’s not a written letter, this is something that comes from the court.

This one is the authorization document that gives you (personal representative) the right to go out and deal with the decedent’s assets.

Let me explain more so that we can be on the same page.

It like this

In order to settle the estate during probate, you will require a Letter of Testamentary if you are designated as an estate executor in California.

The letter gives you complete legal authority to administer and distribute the decedent’s property in accordance with the decedent’s will.

You will need Letters of Testamentary in order to dispose of property, pay debts, and manage any other financial matters related to the estate, together with a valid death certificate and the deceased’s will.

Generally, unless you obtain a Letter of Testamentary naming you as the official estate executor, banks and other financial institutions won’t even consider letting you access the deceased’s assets.

When is probate required in California?

In California, probate is required when the decedent died testate and his/her estates exceed 1$66,250.

If the deceased person owned assets in joint tenancy with someone else, as survivorship community property with his or her spouse, or in a living trust, those assets won’t need to go through probate.

How do I get a letter of testamentary in California?

In order to get a letter of testamentary in California, you must lodge a formal application (Petition) to the superior court in the county where the decedent lived through form DE-111.

On that form, you must indicate that you petition for probate of will and letters testamentary and annex the will.

After your probate case is filed but before the hearing, You must give notice of the hearing to anyone who may have the right to get some part of the estate, plus the surviving family members even if there is a will and they are not named in it.

If everything is ok, the Judge will proceed to hear the case and grant a letter of testamentary

Can You Get a Letter of Testamentary Without a Will?

You cannot receive a Letter of Testamentary if the decedent passed away without a will. Alternatively, you can get a Letter of Administration, which is given to an estate administrator appointed by the court.

With the letter of Administration will be able to perform the same duties as an executor of an estate.

What is the Difference Between Letters of Administration and Letters of Testamentary?

The major difference between Letters of Testamentary and Letters of Administration is this; Letters of Testamentary is given to the executor of an estate who has been named in the deceased’s will. However, if there is no will or the executor can’t fulfill their duties for any reason, the court, through Letters of Administration, will appoint an administrator to oversee the disbursal of the estate.

How long do you have to file probate after death in California?

According to the California Probate Code, you have to file probate within 30 days after the decedent’s death.

You may have unknowingly waived your right to be the executor if you do not file probate within that timeframe.

How much do letters of testamentary cost in California?

The uniform filing fee for the first petition for letters testamentary in California costs $435.

If you hire an attorney, the compensation of the attorney for the Personal representative will be calculated per California Probate Code § § 10810, 10811 as follows

- 4% of the first $100,000 of the gross value of the probate estate

- 3% of the next $100,000

- 2% of the next $800,000

- 1% of the next $9 million

- 0.5% of the next $15 million

- A reasonable amount (determined by the court) for any amounts higher than $25 million

The same rate is applied to calculate the compensation of the Executor.

How long does it take to get a Letter of testamentary in California?

It may take 9 months to 1 ½ years to get a Letter of testamentary in California.

This time frame can be extended significantly if there is a Court backlog, a will is being challenged or other litigation is pending.

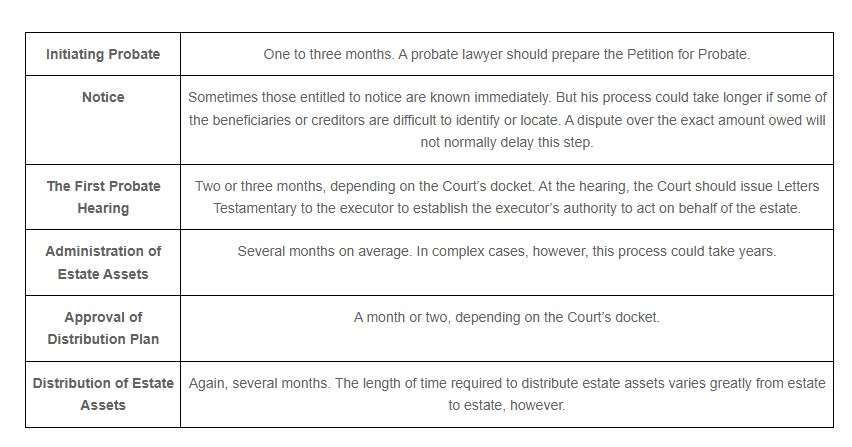

Below is the snapshot of the timeline to get a letter of testamentary in California according to B&Y attorneys

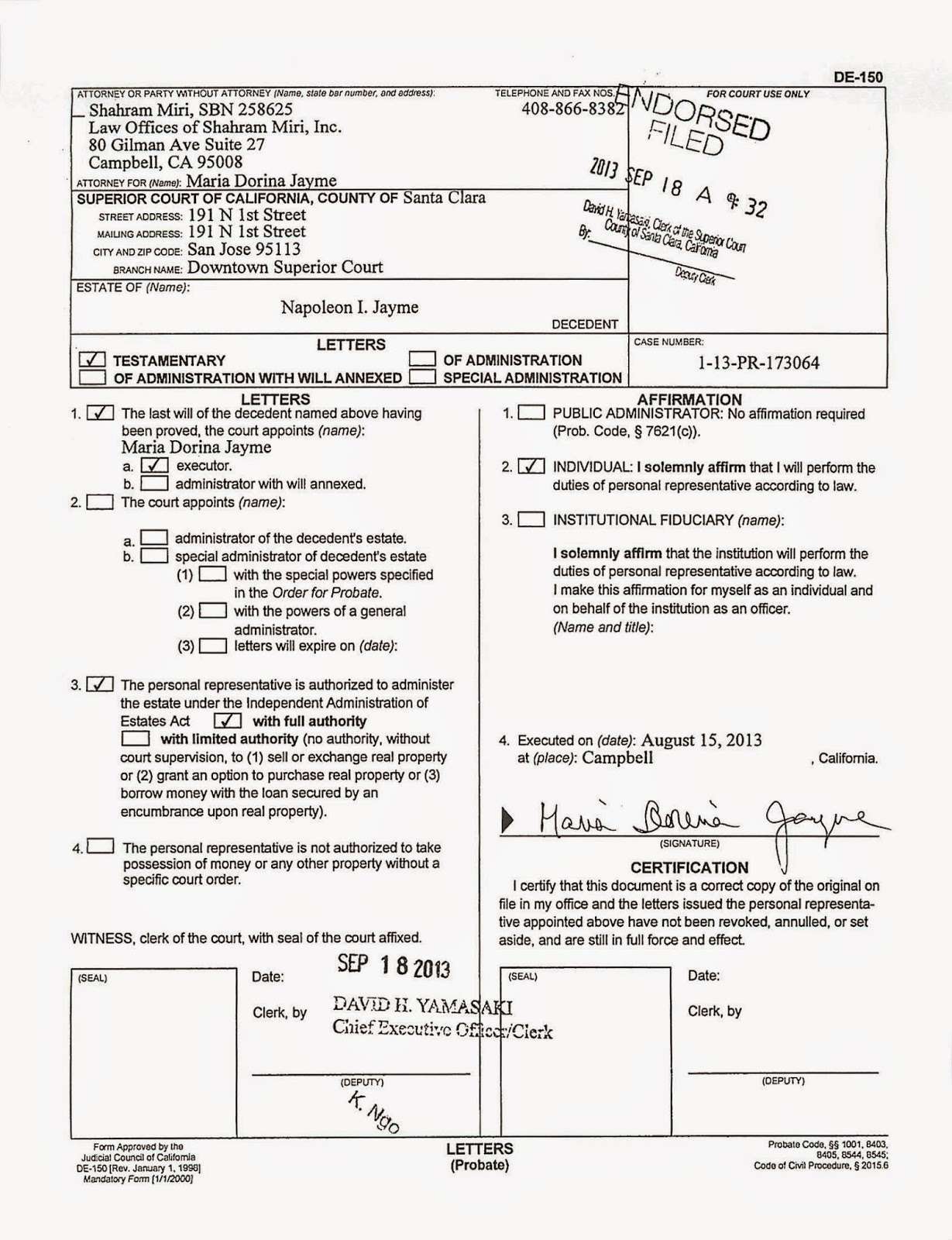

Letter of testamentary California sample (form)

In California, the letter of testamentary is provided as a form, Form DE 150.

The following is an image sample of the filed letters of testamentary in California

FAQ about Letter of testamentary California

What is a Letter of Testamentary in California?

It is a document that serves as proof of a person’s appointment as the executor of a will in California.

How do I obtain a Letter of Testamentary in California?

The document is issued by the Probate Court in California, usually, after the will has been submitted for probate.

Do I need an attorney to obtain a Letter of Testamentary in California?

It is not required to have an attorney, but they can assist in navigating the probate process.

What are the responsibilities of an executor with a Letter of Testamentary in California?

The executor’s responsibilities include managing the deceased person’s assets, paying debts and taxes, and distributing the remaining assets to the beneficiaries.

Is a Letter of Testamentary the same as a will?

No, a Letter of Testamentary is a document issued by the court proving the appointment of an executor, while a will is a legal document that outlines a person’s wishes for the distribution of their assets after death.

Read also:

![How long it takes to become a lawyer? [timeline breakdown] 7 How long it takes to become a lawyer, timeline to become a lawyer, timeline of becoming a lawyer](https://sherianajamii.com/wp-content/uploads/2023/01/How-long-it-takes-to-become-a-lawyer-768x576.png)